DOGE Price Prediction: Technical Analysis Points to Potential Breakout Toward $0.46

#DOGE

- Technical indicators show DOGE consolidating with bullish MACD signals suggesting potential upward momentum

- Market sentiment is mixed with institutional interest offset by resistance at $0.22 and emerging competition from utility altcoins

- Price targets of $0.46 remain achievable if DOGE can break through key resistance levels and maintain current trading volume

DOGE Price Prediction

Technical Analysis: DOGE Shows Consolidation Pattern with Bullish Potential

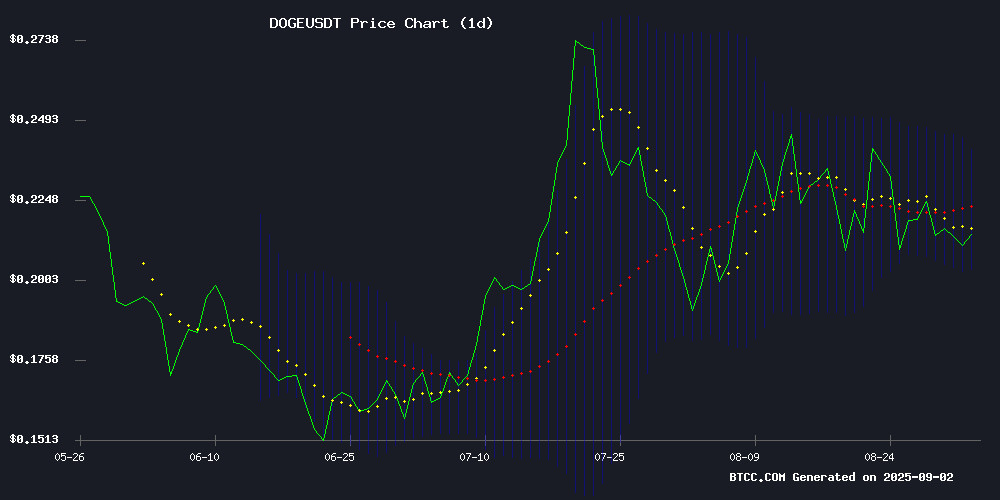

According to BTCC financial analyst Emma, DOGE is currently trading at $0.21349, slightly below its 20-day moving average of $0.221733. The MACD indicator shows a positive reading of 0.004958, with the signal line at 0.003863 and histogram at 0.001095, indicating mild bullish momentum. The Bollinger Bands configuration suggests DOGE is trading NEAR the middle band with upper resistance at $0.240158 and lower support at $0.203307. This technical setup suggests consolidation within a defined range with potential for upward movement if bullish momentum strengthens.

Market Sentiment: Mixed Signals Amid Institutional Interest and Resistance Levels

BTCC financial analyst Emma notes that recent news highlights both opportunities and challenges for DOGE. While institutional interest is growing and some forecasts point to a $0.46 target, the cryptocurrency faces resistance at $0.22 amid elevated trading volume. The emergence of utility altcoins like Remittix presents competitive pressure, but Dogecoin's consolidation in the $0.21-$0.22 range suggests underlying strength. Market sentiment appears cautiously optimistic, with technical levels supporting the possibility of breakout moves if current resistance levels are overcome.

Factors Influencing DOGE's Price

Dogecoin Consolidates in $0.21–$0.22 Range Amid Institutional Interest

Dogecoin exhibited heightened volatility during a 24-hour trading window, mirroring broader cryptocurrency market movements as investors digested macroeconomic signals. The memecoin fluctuated between $0.21 and $0.22, with institutional desks driving two major volume spikes—808.9M DOGE at 07:00 GMT during an upward push and 806M DOGE during the 20:00 retracement.

Corporate treasuries appear to be testing DOGE allocations as a liquid alternative to traditional hedges, particularly amid G7 trade tensions and divergent central bank policies. The $0.21 level emerged as confirmed support after repeated high-volume defenses, while $0.22 resistance held firm despite multiple tests.

Market technicians note the neutral RSI reading near 50 suggests balanced momentum, though a decisive close above $0.225 would signal breakout potential. 'When retail and institutional flows converge on memecoins, you're seeing the maturation of crypto as an asset class,' remarked a prime brokerage analyst speaking on condition of anonymity.

Dogecoin Shows Bearish Signals Amid Consolidation

Dogecoin's price action reflects a cautious market sentiment as it hovers near critical support levels. The cryptocurrency, currently trading at $0.21, has declined 3% over the past 24 hours and 6% weekly. A weak Tenkan-sen/Kijun-sen bearish cross on the daily Ichimoku chart suggests potential downside, though the signal lacks conviction as it appears above the Kumo cloud.

Traders are closely monitoring the $0.23 resistance level, which could trigger upside momentum if decisively breached. The symmetrical triangle formation indicates tightening volatility, with support at $0.21517 and resistance at $0.22444. Monthly rate-of-change metrics remain flat, signaling Dogecoin's major bull cycle has yet to materialize.

Why New Investors Favor Utility Altcoin Remittix Over Dogecoin in 2025

Dogecoin's price volatility and lack of clear momentum have led investors to seek alternatives with stronger real-world utility. While DOGE struggles to break resistance at $0.20-$0.25, whales are diverting attention to projects like Remittix—a PayFi solution bridging crypto and traditional banking.

Technical analysis shows Dogecoin trapped in a symmetrical triangle pattern, with 2 billion DOGE accumulating in long-term wallets despite $200 million in outflows. This uncertainty contrasts sharply with Remittix's growing appeal as a payment infrastructure play.

The market's shift toward functional blockchain applications reflects broader trends in cryptocurrency adoption. Projects demonstrating tangible use cases are increasingly outperforming meme coins in institutional portfolios.

Dogecoin (DOGE) September Forecast: Powerful Setup Points to $0.46 Target

Dogecoin (DOGE) demonstrates resilience, holding steady above critical support at $0.206–$0.209. Market indicators suggest accumulation with a bullish bias, though confirmation requires a close above $0.226. Ambitious targets up to $0.46, highlighted by Rose Premium Signals, have reignited trader optimism.

The cryptocurrency trades at $0.2161, just below a heavy resistance band between $0.218 and $0.222. Weekly charts show price comfortably above key moving averages, with the 20, 50, 100, and 200-week EMAs clustered at $0.214, $0.208, $0.184, and $0.150, respectively. Sustaining above this group maintains favorable sentiment, provided the $0.206–$0.209 support holds.

Bollinger Bands indicate a squeeze, with the mid-band at $0.206 acting as a pivot since spring. The upper limit sits at $0.268, while the lower boundary rests at $0.144, suggesting accumulating volatility rather than dispersion.

Momentum indicators lean bullish. Weekly MACD shows slight positive signals, and the RSI hovers around 50 with an upward slope. Ichimoku charts reveal price gripping the Tenkan line at $0.216–$0.217, while the Kijun at $0.209 serves as a potential pullback zone. The thin cloud structure could quickly yield to upward momentum if resistance levels break.

Dogecoin Faces Resistance at $0.22 Amid Elevated Trading Volume

Dogecoin (DOGE) encountered stiff resistance at $0.22 during a volatile 23-hour trading session, with on-chain data revealing a 14% surge in trading volume to 808.9 million DOGE. The spike, double the daily average, suggests institutional players are accumulating the meme coin despite broader market choppiness.

Price action saw DOGE oscillate between $0.21 and $0.22, with the lower bound repeatedly tested and defended. A concentrated 60-minute window featured a 13.9 million DOGE transaction at $0.21, further signaling institutional interest. Meanwhile, traders rotated into alternative meme coins like XYZVerse and MAGACOIN FINANCE, reflecting a diversification trend away from established tokens.

Technical indicators point to $0.21 as a firm support level, while $0.225 remains the key breakout target. The macroeconomic backdrop of geopolitical tensions and monetary policy divergence continues to drive interest in crypto hedging instruments.

How High Will DOGE Price Go?

Based on current technical indicators and market sentiment, BTCC financial analyst Emma suggests DOGE could potentially reach $0.46 in the coming months, representing approximately 115% upside from current levels. However, this target depends on overcoming key resistance at $0.22 and maintaining bullish momentum. The following table summarizes key technical levels:

| Indicator | Current Value | Significance |

|---|---|---|

| Current Price | $0.21349 | Below 20-day MA, near support |

| 20-day MA | $0.221733 | Immediate resistance level |

| Bollinger Upper | $0.240158 | Medium-term resistance |

| Bollinger Lower | $0.203307 | Key support level |

| MACD Histogram | +0.001095 | Bullish momentum building |